Investment Strategies

Investment Strategies

Depending on the market environment and the investment goals of our partners, we focus on three proven strategies to add value to multifamily assets:

1

Urban Center Value-Add Model

American’s great urban cities contain plentiful older, well-constructed but unrenovated apartment buildings in desirable neighborhoods. An example is Boston, Massachusetts. Many are owned by local families or small operators who perhaps bought them long ago at a much lower basis and are quite content to maintain the status quo by simply maintaining the assets. Given the housing scarcity in these markets, the large number of affluent renters, the historic nature of the target neighborhoods (which inhibits large scale demolition and replacement), we believe an important phase of the investment cycle will be the transfer of these mom and pop buildings to larger operators who will inject capital, upgrade the building interiors and provide city-dwellers a middle ground between beautiful old buildings with dated interiors and newly build high-rises costing thousands more per month.

Affordable Housing

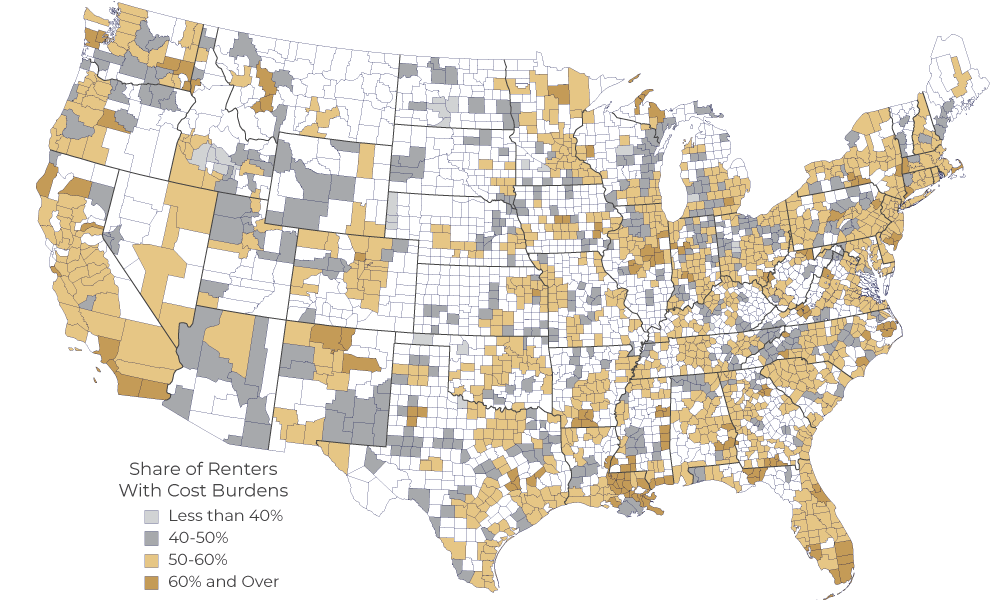

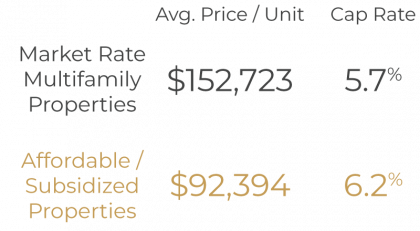

The corollary to positive multifamily investment fundamentals such as the supply/demand disparity and rising rents is a scarcity of housing in general and specifically affordable housing.

40% of renters in the U.S. are “rent burdened”, meaning that rent is more than 30% of their income. The probability is high that this dynamic will continue. It is estimated that there exists a shortage of 7.2 million affordable units in the U.S. Future strong demand for affordable units is an absolute.

Consumer demand coupled with a complex array of favorable financing, tax incentive and grant programs, less competitive bidding and reliable, subsidized and regularly escalated income streams creates opportunity for above-market returns for the savvy investor/operator while addressing an important societal issue.

MAA possesses substantial expertise in the field of affordable housing investment. In 2004, MAA founding principal Christopher Thomson was designated a “certified principal” by the Texas Department of Housing and Community Affairs, an exhaustive background and competency vetting required of operators who wish to access affordable housing funds and/or operate affordable housing properties in the State. Two of three recent MAA acquisitions in the Boston metro have affordable components.

Affordable housing strategies that can be employed based on investor objectives include:

- Tax-Advantaged “Opportunity Zone” investment

- Acquisition and rehabilitation of Low-Income Tax Credit properties

- Modular and micro-unit development

- Adoption and/or expansion of Housing Choice Voucher tenants at targeted properties

- Utilizing relationships with Minority Business Enterprises (MBE) to access targeted incentives

3

The "Classic" Workforce housing value-add

Class

We focus on Class “B” “workforce housing” multifamily assets of 150 units or more in current or transitioning Class “B” or better locations.

Age

Age guidelines vary with market type. In suburban locations, vintage will generally be 1970-1999 construction. In urban markets, Class “B” assets can be much older.

Condition

We seek assets that are generally well-constructed with sound major systems. We will not seek “gut” rehab or major turnaround situations.

Value-Add Potential

We seek properties expected to benefit from our value-add “toolkit”; those with largely “classic units,” sub-optimal management, minor deferred maintenance, limited technology offerings, no revenue management, inefficient utilities and/or a lack of curb appeal.

4

Repurposing Multifamily Assets to Short-Term Rentals Operations

In a positive lodging environment, we can dramatically enhance the value of targeted existing and newly constructed Class “A” multifamily buildings in destination markets. MAA and its investors enter a Master Lease arrangement with one of a few well-capitalized short-term rental operators with whom MAA has relationships.

These Master Leases are generally for a 10-Year term with a base rate that generally equals or exceeds the Property’s conventional market rent. In addition to ensuring 100% occupancy, the short-term rental operator generally assumes all operating expenses other than property tax, property insurance and capital reserves. The effect of eliminating all economic vacancy combined with substantially reducing the operating expense of the Property results in a Net Operating Income under the master-lease structure that is typically a multiple of what the conventional multifamily Net Operating Income would be for the same asset.

Conventional Model

MAA Master Lease