SENIOR HOUSING

THE CASE FOR MULTIFAMILY IS COMPELLING.

IN THE NEAR TERM, THE SENIOR HOUSING CATEGORY MAY BE THE BEST WAY TO PLAY IT.

Senior housing shares the benefits of conventional multifamily. and then some. In its continual effort to drive value and produce outsized returns within the multifamily sector, MAA is initiating an ambitious senior housing acquisition program.

Tax Advantaged Income

Investors utilizing leverage depreciation, cost-segregation and Section 1031 exchanges can defer taxation on much of their real estate income into perpetuity. Senior Housing amplifies this as it generally has a higher percentage of personal property, which can be depreciated on a shorter schedule. You can defer and even save significant federal tax dollars simply by investing in Senior Housing assets.

Inflation Hedge

Multifamily investments have proven to be virtually a perfect inflation hedge - .98 correlation since 1978 when reliable data became available. Over the last 15 years, the Senior Housing category of the multifamily asset class has generated even higher returns and has been even more resistant to economic downturns, thus acting as an even more effective hedge than the general multifamily asset class.

Recession Resistant

JP Morgan looked at the worst five-year periods for various investments from 1977-2012 and calculated total return (including cash flow). $100 invested in apartments at the beginning of the worst five-year period for real estate was worth $110 at the end. A portfolio of 60% stocks/40% bonds was worth $94 at the end of its worst five years. Senior Housing, a sub-group of the apartment sector takes this a step further, as the only commercial real estate asset class to increase asking rents during the Great Recession.

Superior Returns

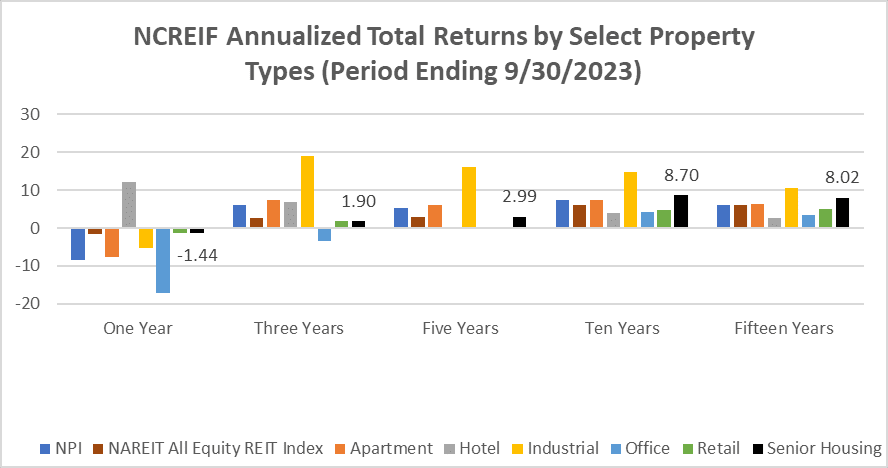

Since at least 1987, when reliable data became available, Real Estate as an asset class has outperformed every other asset class in real, compounded return. Multifamily has posted the highest risk-adjusted returns within the real estate asset class across all multi-year holding periods. Within the Multifamily sector, Senior Housing, which includes Assisted Living facilities has outperformed the sector for the last 10-year and 15-year periods.

AMPLIFIED OPPORTUNITY TO ADD VALUE

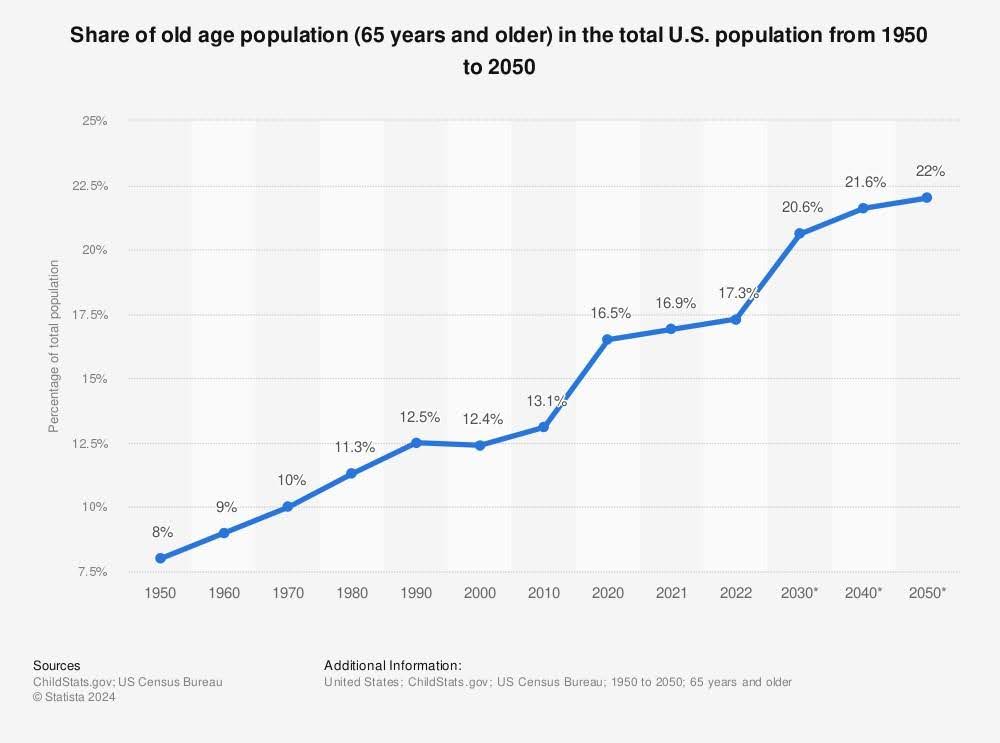

SENIOR HOUSING’S EXCEPTIONAL PERFORMANCE MAY BE AMPLIFIED IN THE NEAR TERM BY A “SUPER-CYCLE” PHASE DRIVEN BY THE FOLLOWING TRENDS:

DURABLE DEMAND GROWTH DUE TO AGEING OF THE POPULATION

CONSTRAINED SUPPLY IN THE NEAR TERM

A RENT-GROWTH VACUUM THAT WILL CORRECT

The ratio of home values to senior living costs is an important barometer of affordability. 79.1% of all seniors aged 75+ own their own home. The sale of that home is often the means of financing a senior’s tenure at a private pay senior housing facility. Since 1970, the average sale price of a home in the U.S. has risen from $26,600 to $511,100, an astounding 5.74% compounded growth rate over that period. The growth rate of senior living facility costs should correlate closely with this figure over the long term.

However, over the last decade, the relative affordability of senior housing has increased dramatically against a backdrop of decreasing affordability of other housing alternatives. The average proceeds from selling a home today covers approximately seven years of the average annual rent/care cost of seniors housing versus four years in 2011.

From 2017 to 2022, Senior housing rents grew 20.1% versus apartment rents at 35.9% and single-family homes which appreciated 48.1%. Senior housing costs should find equilibrium via disproportionate growth over the near term.

INFLECTION POINT POST-PANDEMIC

A 900 basis-point decrease in average occupancy combined with a dramatic rise in expenses, due mainly to a challenging labor market. resulted in a 13% average decrease in Net Operating Income in early 2021 (coinciding with the end of the pre-vaccine COVID era). Moderating labor costs and eight straight quarters of strong absorption confirm a durable inflection point, at which investors can feel confident in the long-term direction of the operating environment.

CURRENT OWNERS PRESSURED BY MISALIGNED CAPITAL STRUCTURE

Current owners, many of whom experienced the negative effects of the Post-COVID/Pre-Vaccine era face new pressure in a debt market with rising rates and limited availability. Owned assets, already beset by reductions in Net Operating Income and saddled with capital structures geared for a much lower interest rate environment, will require fresh capital or new ownership.

Senior housing has a unique resiliency in the commercial real estate market as a result of its dual components of real estate, hospitality, and need-driven services. The NCREIF Property Index (NPI) had a total investment return of 9.4% for the ten years ending in the third quarter of 2020. Seniors housing returns compare favorably to this overall index, with an 11.6% annualized investment return over the same period. Returns for both income and appreciation were higher for seniors housing than the overall property index as well as for multi-family.

Source: NCREIF, The National Investment Center for Seniors Housing & Care (NIC)

RESILIENCE TO ECOMONIC DOWNTURNS

The financial performance of senior living has shown greater resilience in recent economic cycles compared to almost all other real estate sectors. According to the National Council of Real Estate Investment Fiduciaries (NCREIF), the senior living sector’s annual returns through 2019 exceeded all other real estate sectors’ returns on a long term basis. The 10-year total returns for senior housing in 2023 is the second highest (following industrial), according to the NCREIF National Property Index (NPI).

This out-performance includes the distress caused during the COVID-19 event pre-vaccine, an outlier event that caused significant distress and negative returns in the segment. Also, the projected out-performance is generally comprised of years that precede the “perfect storm” of demographic factors driving a “super-cycle”. Senior housing has out-performed most real estate classes over the long-term and all indicators point to those return premiums increasing.

Potential Cap Rate Compression Due to Capital Inflows

MAA was an early adopter in the multifamily surge of the last ten years. Senior Housing also has all the earmarks of a sector to which capital inflows will continue to increase, triggering cap rate compression and more competitive bidding. Exploiting this dynamic by establishing a beachhead in the early stages of this transition has the potential to further increase the value of already high value-add opportunities.

We believe Senior Housing ALMC contains all the meaningful benefits of multifamily plus certain benefits of a business with skyrocketing demand.