Why Multifamily

Why Invest in Multifamily Assets?

Tax Advantaged Income

Investors utilizing leverage depreciation, cost-segregation and Section 1031 exchanges can defer taxation on much of their real estate income into perpetuity.

Inflation Hedge

Multifamily property values have proven to be virtually a perfect inflation hedge - .98 correlation since 1978 when reliable data became available.

Recession Hedge

JP Morgan looked at the worst five-year periods for various investments from 1977-2012 and calculated total return (including cash flow). $100 invested in apartments at the beginning of the worst five-year period for real estate was worth $110 at the end. A portfolio of 60% stocks/40% bonds was worth $94 at the end of its worst five years.

Superior Risk-Adjusted Returns

For decades, multifamily has exhibited the least volatility and highest risk-adjusted returns of all real estate asset classes. This long-term performance along with tax and hedging benefits has been amplified in the short term by two additional factors:

Exceptional long-term performance

has been amplified in the shorter term

by two additional factors:

Supply/Demand Imbalance - Available Units vs. Demand

For decades, creation of renter households has outpaced creation of new apartments. This disparity increases each year. As the disparity increases, so does pricing power and revenue growth for apartment owners and investors.

2,099,000

Number of New Apartments Constructed: 2005-2018

Source: Statista/CBRE

9,170,000

Number of New Renter Households: 2005-2018

Source: U.S. Department of Housing and Urban Development

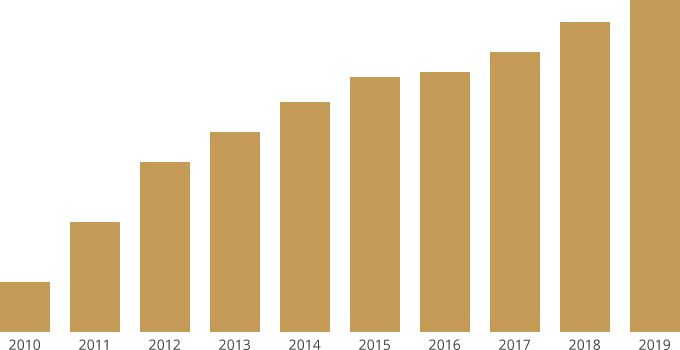

Massive Capital Inflows

Because of the risk-return profile and favorable market fundamentals, domestic and global capital flow to U.S. Multifamily continues to explode. Combined with asset revenue growth, this fuels price appreciation.

As measured by total multifamily loan originations, annual multifamily acquisition volume has increased 642% since 2009.

Source: Mortgage Bankers Association