Recent Tax Changes

The Tax Cuts and Jobs Act of 2017 contained important changes to existing tax law. A provision dealing with “bonus depreciation” provides multifamily investors, among others, the ability to substantially reduce their tax burden immediately (in the year of acquisition) by simply acquiring a multifamily asset. This law remains in effect for properties acquired through December 31st, 2022. Beginning January 1, 2023, investors may continue to benefit from this provision. But the amount of the benefit is reduced over a five-year phase-out.

Beginning on January 1, 2018, a new provision in the federal tax code enabled real estate investors to reduce or even eliminate their federal tax due simply by buying real estate.

MULTIFAMILY REAL ESTATE DEPRECIATION EXPLAINED

A residential investment real estate asset is typically depreciated over a 27 ½ year schedule. The cost of the improvements (exclusive of land) is divided by 27.5 and this is deducted each year from taxable income. This is known as “straight line” depreciation.

While “real estate” in the strict sense is not eligible to be depreciated using an accelerated schedule, certain systems and components attached to the real estate can be depreciated over a shorter schedule, typically 5,7 or 15 years. These items can include:

Floor Coverings

Cabling

Wiring

Plumbing

Lighting

Sidewalks

Curbs

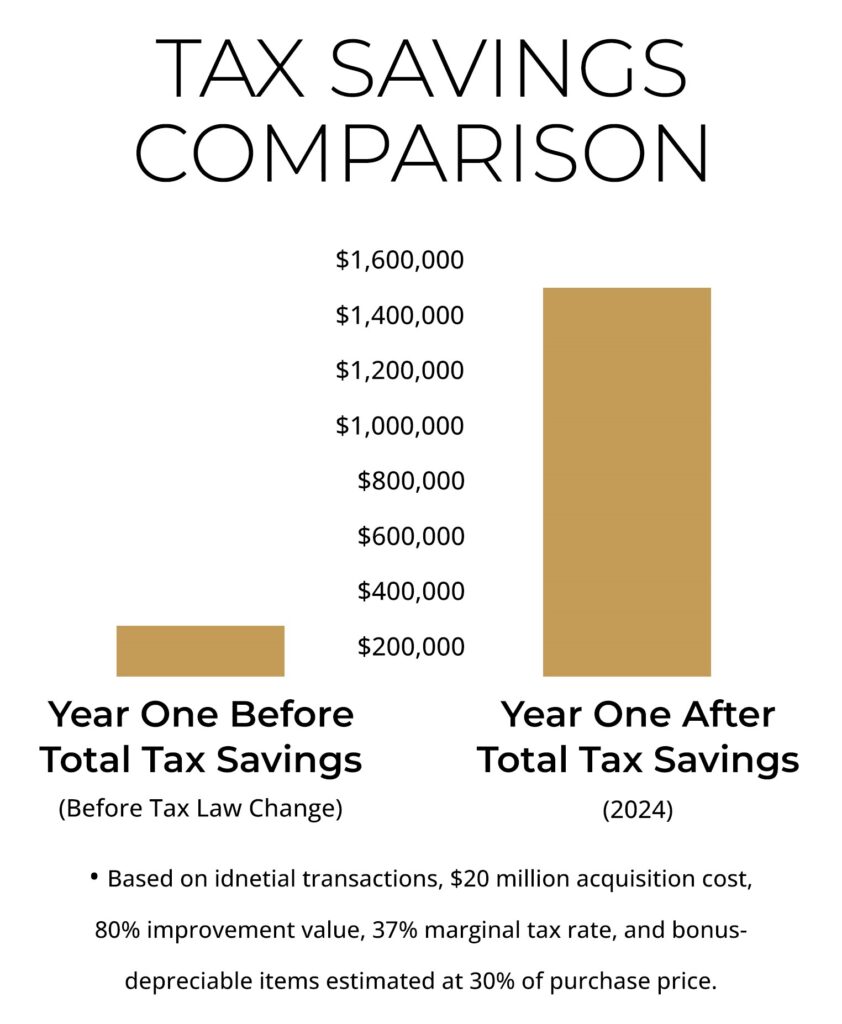

To stimulate investment, the Act shortened the schedule, increasing the immediate deduction. This is known as Bonus Depreciation. In 2024, 60% of the value of these items can be depreciated in the year of acquisition.

The collective value of these items for a multifamily asset can equal 20%-40% of the Total Cost of the asset. Prior to or post-closing, a “Cost Segregation Analysis” is conducted by an accredited accounting firm to categorize and value each component and system eligible for Bonus Depreciation. The results of this study are used to calculate the actual deductions.

Example: In 2024, an investor in the 37% tax bracket purchases a $20 million apartment property using $4 million cash and a $16 million dollar mortgage. A Cost Segregation Analysis determines that bonus depreciation-eligible items total 30% of the value of the Property, or $6 million. The investor is allowed to deduct 60% of this total or $3.6 million in the year of acquisition (2024). The investor reduces his or her tax liability by 37% X $3,600,000 or $1,332,000.

Note that normal straight-line depreciation is still allowed in addition to the accelerated Year One Bonus Depreciation (hence the term “Bonus”).

Since depreciation reduces your cost basis, taxes are generally deferred until sale but not eliminated. However, if a Section 1031 transfer is utilized upon sale of the Property, the tax may be again deferred until you sell the second property, which can be transferred yet again using a Section 1031 Exchange and so on.

And for most investors, there may also be actual tax savings rather than just deferral. This is because many wealthy investors’ top marginal tax rate (37%) is higher than the rate at which the accumulated depreciation is taxed upon sale (currently 25%). If the Property is sold for example at the end of Year One and no tax mitigation strategy is employed, total taxes saved (versus deferred) would equal the difference between 25% of $4,800,000 and 37% of $4,800,000 or $576,000. *All investors should consult a qualified tax professional with respect to their specific tax situation*.